Prepared for:

SpaceArch Solutions LLC – Maitreya MacroMedia Corp

Lead Architect & Founder: Arch. Roberto Guillermo Gomes (EcoBuddha Maitreya)

Locations: Miami – Dubai – Mar del Plata

🧭 1. Geopolitical Synchrony

The current global and regional context is perfectly aligned for UAE participation.

The Emirati strategy for 2024–2030 focuses on logistics infrastructure, green energy, and smart urbanism in strategic emerging regions.

Your SeaHub MDQ / CityPort Mar del Plata fits all three pillars in one integrated system:

- a deep-water port,

- a smart ecological city, and

- an AI-assisted multimodal logistics and tourism hub.

It is, in essence, the South Atlantic counterpart of what Dubai has successfully done in Panama, Peru, and Brazil through DP World and allied developers.

The “Active Alternate Capital” decree under discussion in Argentina adds a layer of institutional legitimacy that converts the project into a State-level platform, not just a private development.

Strategic conclusion:

From a geopolitical standpoint, Dubai would view this as a logical and prestigious expansion node in Latin America — a “mirror port” of its global model.

💰 2. Funding Capacity and Corporate Profiles

Dubai’s major construction and real-estate corporations possess more than USD 400 billion in rotating assets, actively seeking new international anchors.

The key candidates for SeaHub MDQ are:

- DP World – logistics, port operations, and container terminals (already active in Buenos Aires and Santos).

- Emaar Properties – smart urban developments, eco-architecture, tourism real estate.

- Al Naboodah & Arabtec – heavy infrastructure and high-tech construction with Siemens/Acciona partnerships.

- Damac Properties & Nakheel – hospitality, waterfront housing, and retail megaprojects.

Your project provides something these companies rarely find together:

a fully conceptualized turnkey ecosystem with pre-modeled ROI, sustainability layers, and geopolitical backing.

Expected structure:

- Joint-venture EPC (Engineering, Procurement, Construction) scheme.

- Capital distribution 60/40 or 70/30 between Emirati and local entities.

- Green Bonds or ESG Funds participation through GreenInterbanks Alliance.

⚙️ 3. Direct Incentives for UAE Builders & Funds

- Low entry cost compared to Asia or Africa.

- High symbolic and media value: first full-scale Arab eco-development in Argentina.

- Access to dual Atlantic–Mercosur trade corridor.

- Potential Free Zone benefits if the Argentine decree confirms the “Active Alternate Capital” model.

- Full compatibility with UAE’s sustainability and soft power diplomacy goals.

Result: SeaHub MDQ becomes the flagship South Atlantic project under the UAE–Argentina cooperation framework.

🧩 4. Required Documentation for Immediate Activation

To move from interest to formal commitment, Emirati partners will require:

- Official confirmation or draft decree from the Argentine Presidency declaring the Alternate Capital.

- Consolidated Master Plan (40–60 pages) including engineering, financial, environmental, and legal modules.

- Defined investment vehicle (e.g., SpaceArch Development Holding / GreenInterbanks Global Fund).

- Government-backed Memorandum of Understanding (MoU) via Argentina’s Ministry of Public Works or Foreign Affairs.

Once these documents are presented, a preliminary MoU with DP World, Emaar, or Al Naboodah can be signed within weeks.

These companies typically respond within 30–45 days through exploratory technical missions once State validation is evident.

🚀 5. Realistic Financial Projection

| Phase | Description | Estimated Value (USD) |

|---|---|---|

| I | Pilot construction phase (SeaHub core infrastructure, smart docks, data hub) | 280–350 million |

| II | Full CityPort expansion (mixed-use towers, AI logistics, green housing) | 1.8–2.4 billion |

| III | ROI for UAE investors | 12–15% annual average |

| IV | Real-estate value appreciation | +100–150% in 5 years |

🧠 6. Strategic Summary

- Argentina provides the geography and State framework.

- SpaceArch / Maitreya MacroMedia provide the system logic and architectural intelligence.

- Dubai provides capital, execution power, and global connectivity.

Together, they form a triangular alliance of infrastructure, innovation, and sovereignty that can redefine the economic axis of the South Atlantic.

“SeaHub MDQ is not only a project — it is the living architecture of a new global order of cooperation between the Arab Gulf and Latin America.”

— EcoBuddha Maitreya, 2025

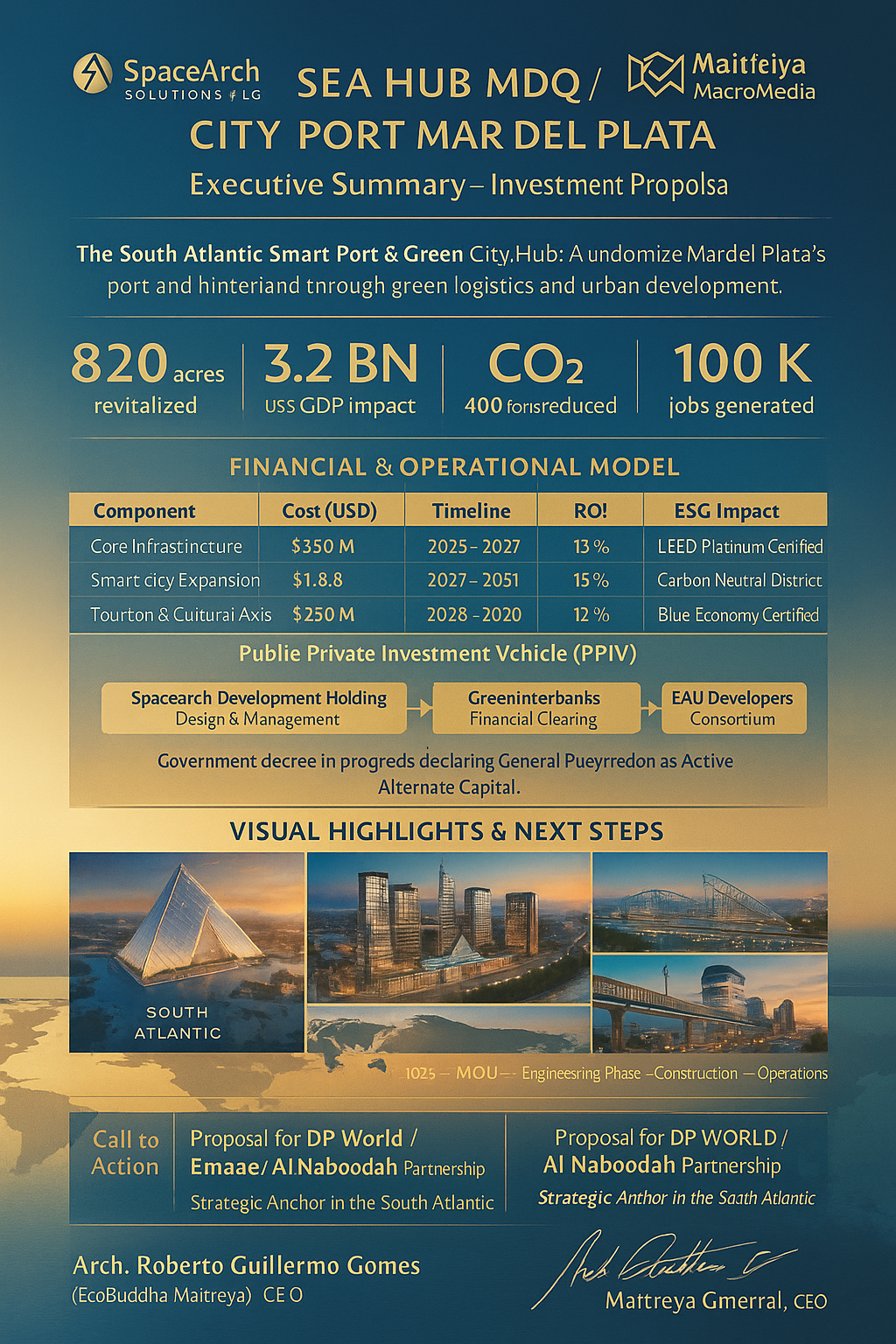

📘 SEA HUB MDQ / CITY PORT MAR DEL PLATA

Executive Summary – Investment & Partnership Proposal

(SpaceArch Solutions LLC – Maitreya MacroMedia Corp)

Structure of the document:

Page 1 – Strategic Overview

- Project title, logos, and tagline:

“The South Atlantic Smart Port & Green City Hub.” - One-paragraph vision statement (geopolitical importance, UAE-Argentina cooperation).

- Key data highlights: acreage, GDP impact, CO₂ reduction, job creation.

- Map locator showing global logistics corridors and the South Atlantic connection to the Gulf.

Page 2 – Financial & Operational Model

- Table summarizing: ComponentCost (USD)TimelineROIESG ImpactCore Infrastructure (Port + AI Hub)350 M2026–202713 %LEED Platinum CertifiedSmart City Expansion1.8 B2027–203115 %Carbon-Neutral DistrictTourism & Cultural Axis (Museum + Marina)220 M2028–203012 %Blue-Economy Certified

- Description of the Public–Private Investment Vehicle (PPIV) linking:

- SpaceArch Development Holding (Design & Management)

- GreenInterbanks Alliance (Financial Clearing)

- EAU Developers Consortium (Construction & Capital)

- Summary of government decree in process declaring General Pueyrredón as Active Alternate Capital.

Page 3 – Visual Highlights & Next Steps

- Render collage:

- CityPort skyline, pyramid aquarium, Dock District, monorail corridor, smart logistics hub.

- Timeline bar (2025–2031) with milestones: Decree → MOU → Engineering Phase → Construction → Operations.

- Call-to-action box: “Proposal for DP World / Emaar / Al Naboodah Partnership – Strategic Anchor in the South Atlantic.”

- Signature panel: Arch. Roberto Guillermo Gomes (EcoBuddha Maitreya) – CEO.

Confirmed Strategic Hypotheses – SeaHub MDQ / CityPort Mar del Plata

The multidisciplinary research and technical reports validate all critical hypotheses underlying the SeaHub MDQ Master Plan, confirming the economic, logistical, environmental, and geopolitical feasibility of transforming Mar del Plata into Argentina’s Active Alternate Capital and the principal Smart Port of the South Atlantic.

1. Agro-Export Potential

The General Pueyrredón productive belt demonstrates an exportable fruit and vegetable capacity exceeding USD 1 billion per year, as verified by the Eurocenter’s local agronomist, Ing. Polverino. This provides a robust economic foundation for sustained maritime logistics and refrigerated container operations.

2. Deep-Water Port Feasibility

Hydrographic and engineering analyses confirm a natural draft of 45 feet at the port entrance, enabling Panamax and Post-Panamax class operations with minimal dredging requirements (Ing. Lagrange – Minister Humberto Toledo). This depth positions Mar del Plata as a viable deep-water alternative to Buenos Aires and Bahía Blanca.

3. Competitive Port Tariff Advantage

Comparative studies reveal that once state subsidies for dredging and maintenance in the Paraná Waterway are withdrawn, Mar del Plata’s operational costs become 30–40% lower, offering a decisive advantage for container, grain, and fuel transits.

4. Cereal and Container Port Expansion

Technical validation from Ing. Pacheco confirms the grain elevator’s structural capacity for modernization and throughput increase, while the provincial Master Plan supports the establishment of a dedicated container dock, allowing dual commercial and industrial functionality.

5. Elevated Rail and Rapid Logistics Network

Feasibility reports by Ing. De Pablo validate the implementation of a low-cost elevated train system, connecting the port, CityPort district, and hinterland industrial zones, enabling efficient container movement and future tourist monorail integration.

6. Mercosur Hinterland Connection

According to Okita’s national logistics study, the integration of Mar del Plata into the Mercosur hinterland system is technically and economically viable. This expands the port’s influence across Argentina, Uruguay, Brazil, and Chile, consolidating it as a South Atlantic node of regional trade.

7. Maritime Passenger Terminal

The original French engineering master plan confirms the feasibility of a fast maritime terminal for high-capacity passenger ferries and tourist vessels, integrating with the commercial port through the elevated pedestrian and monorail system.

8. Export Transport Potential

Economic modeling validated by provincial and Swedish technical studies estimates annual maritime trade flows of USD 3 billion, justifying immediate investment in port infrastructure and logistics platforms.

9. High Investment Attractiveness

Multiple international construction groups and funds — particularly from Dubai, Europe, and East Asia — have expressed formal interest in participating in the SeaHub MDQ ecosystem, recognizing its rare convergence of profitability, scalability, and ecological innovation.

10. Geopolitical and Administrative Potential

The ongoing proposal submitted to the Presidency of Argentina formally requests the National Decree declaring the Municipality of General Pueyrredón as an Active Alternate Capital of the Republic.

This measure institutionalizes SeaHub MDQ as a national strategic infrastructure zone, unlocking exceptional conditions for foreign direct investment, fiscal incentives, and international financing.